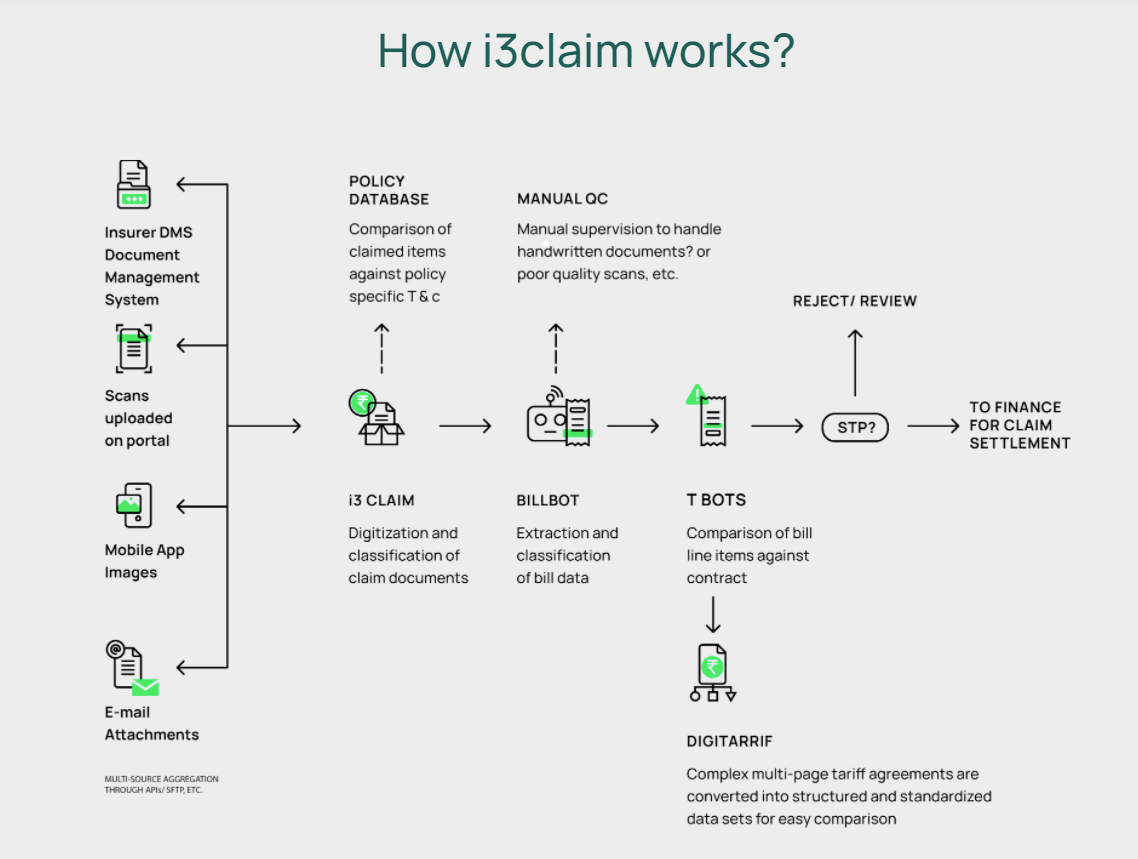

i3Claim: End to end Claims Processing Automation solution

With increasing complexities and evolving consumer demands, digitisation of the claims process has become essential for insurers to ensure fast settlement & payment of claims as well as drive customer satisfaction and set standards of service.

However, traditional claims processes involve intensive document-driven operations and the processing of non-structured data in multiple formats/nomenclature, making it difficult for insurers to process claims efficiently and quickly.

i3claim helps in capturing significantly more data-points in much lesser handling time. It reduces the extent of manual data capture and human errors in the entire claims process by more than 60%, making it much faster and extremely scalable.

i3claim accepts data input from a variety of sources like Hospitals, Pharmacies and Diagnostic centres. It extracts, classifies, and standardizes non-structured data present across multiple documents.

i3claim reduces the claims process to a single queue, by automating several parallel activities. This improves efficiency and leads to a reduction in cashless discharge time from 4 hours to less than 30 minutes for 90% of the cases. AI-assisted processing covers accurate capture of Non-payable and tariff comparison on 60% of the line-items. This has led to an average of USD 200-5000 savings per claim compared to manual processing.