Payers constantly change the rules. Sift evens the playing field. Sift equips healthcare organizations to fully leverage their payments data to work smarter, protect their margins and accelerate cash.

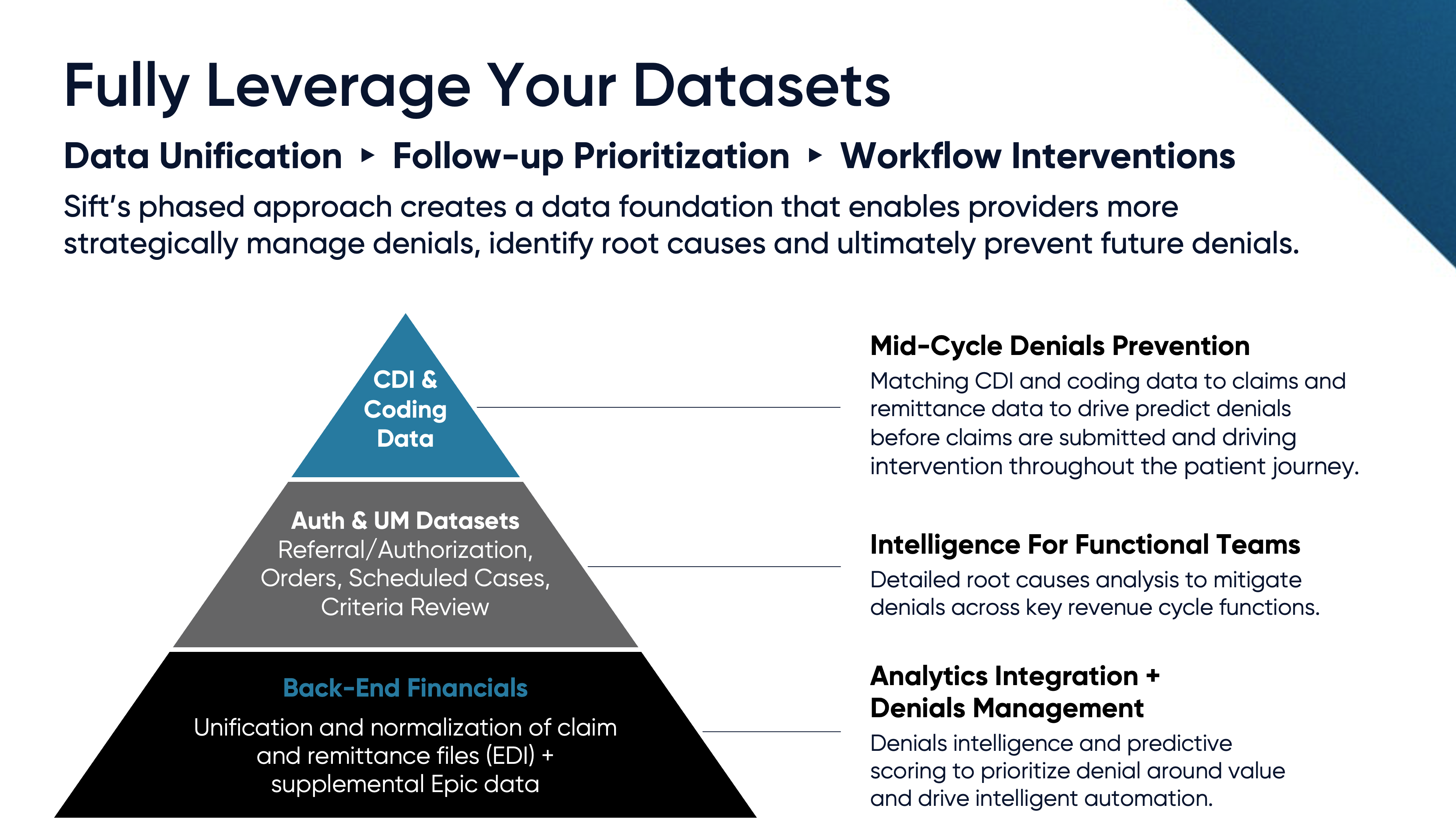

Actionable Denials Intelligence, delivering a longitudinal view of clinical, coding, claims and remittance data. Sift establishes a data foundation that gives providers unprecedented access to their payments data and intelligence tools to better manage their denials, identify root causes and prevent future denials.

- Unified, normalized and organized claims and remittance data.

- Delivering an accessible and complete picture of claim behavior, payer trends and the drivers of denials.

- Curated, consultative analysis pinpointing where your team can take action to prevent denials and optimize workflows.

Denials Prioritization & Intelligent Automation to better manage touches and lower the cost of delivering each dollar of cash.

- Sift’s machine learning optimizes workflows by prioritizing your team’s denial work efforts around ROI and by delivering Smart Claim Edits that improve first-pass yield.

- Active-Learning Claim Scrubber analyzes daily claims and remittances to curate high-impact claim edit recommendations.

- Machine learning models that score denials at an atomic claim level, using over 500 attributes to determine each denial’s likelihood to overturn.

- ROI-based denials worklists seamlessly integrate into your EMR, prioritizing high-recovery denials in staff workqueues.

- Scoring that enhances existing automation capabilities, enabling the strategic automation of low-yield accounts while avoiding over-automating recoverable accounts.

Denials Prevention. By unifying clinical, coding and payments data, Sift's ML predicts denials before claims are created and provide recommendations for upstream interventions.

Sift’s ML models predict the likelihood of denial and provide pointers for intervention and prioritized user analysis, working to optimize payment outcomes.

- Machine learning models score encounters around their likelihood of being denied, proactively flagging encounters for intervention before claim submission.

- Denial category prediction and root causes pointers enable routing to the appropriate mid-cycle workflow for mitigation.

- Mid-Cycle Denials Intelligence that ties back-end billing, denial and overturn patterns to upstream workflow data inputs to deliver root cause analysis and prevention recommendations.